What Is Reconciliation in Accounting? Definition, Types & Steps

Using the double-entry accounting system, he credits cash for 20,000 ZAR and debits his assets (the car tax loss harvesting+ cleaning equipment) by the same amount. For his first job, he credits 5000 ZAR in revenue and debits an equal amount for accounts receivable. Johannes has therefore achieved reconciliation because both his credits and debits are equal. The process is particularly valuable for companies that offer credit options to their customers.

We and our partners process data to provide:

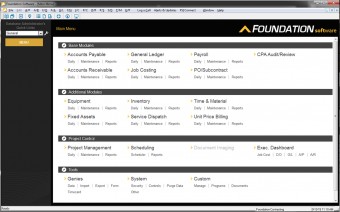

Clio’s legal trust management software, for example, allows you to manage your firm’s trust accounting, reconcile directly in Clio, and run built-in legal trust account reports. Bank reconciliation is an accounting process where you compare your bank statement with your own internal records to ensure that all transactions are accounted for, accurate, and in agreement. This reconciliation process allows you to confirm that the records being compared are complete, accurate, and consistent. A reconciliation involves matching two sets of records to see if there are any differences. Reconciliations are a useful step in ensuring that accounting records are accurate. If a difference is found during a reconciliation, it may be caused by a timing issue, where documentation has been recorded in one of the accounting records, but not the other.

What is reconciliation in accounting?

But there are chances that the check could have bounced due to numerous reasons. A three-way reconciliation is a specific accounting process used by law firms to check that the firm’s internal trust ledgers line up with individual client trust ledgers and trust bank statements. For lawyers, this process helps to ensure accuracy, consistency, transparency, and compliance.

How Often Should a Business Reconcile Its Accounts?

Once you have a solid starting point, look at the reconciling items in last period’s ending balances. The more you reconcile any kind of account, the more likely it is that you will pick up discrepancies. It also enables you to monitor cash flow and control the potential for theft. A company would then be able to put right any mistakes in its financial statement. The result would give a far more accurate picture of the company’s true financial status.

Individual transactions are the building blocks of financial statements, and it is essential to verify all transactions before relying on them to produce the statements. Account reconciliation is a process that involves identifying discrepancies between business ledgers and outside source documents. Accuracy and strict attention to detail are the fundamental principles of this process. Various factors, such as timing differences, missing transactions, and mistakes can cause these discrepancies. Intercompany reconciliation is a process that occurs between units, divisions, or subsidiaries net income after taxes niat of the same parent company.

- Understanding this fundamental practice is vital for businesses aiming to achieve accurate financial reporting and make informed decisions.

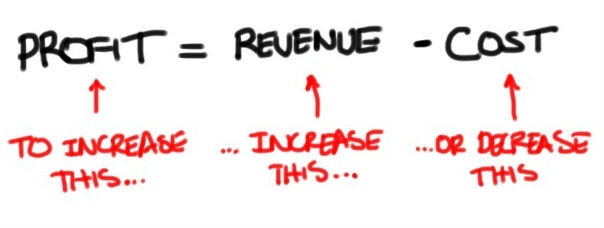

- In business, this would typically mean debits recorded on a balance sheet and credits on an income statement.

- We refer to them as bank, vendor, customer, business-specific, and intercompany reconciliation.

In contrast, a consulting firm may find that monthly reconciliations for invoices and expenses are enough. Meanwhile, a construction company dealing with equipment and material costs may choose quarterly reconciliations to guarantee their financial processes operate smoothly. By catching these differences through reconciliation in accounting, you can resolve discrepancies, help prevent fraud, better ensure the accuracy of financial records, and avoid regulatory compliance issues. It not only allows you to protect your clients’ funds, but your firm too as a result. Individuals should reconcile bank and credit card statements frequently to check for erroneous or fraudulent transactions. Did you know there’s more than one way to reconcile your accounting records?

Who should prepare the account reconciliation?

Businesses and companies need to conduct reconciliation to ensure the consistency and accuracy of financial accounts and records within the business. The account conversion method is where business records such as receipts or canceled checks are simply compared with the entries in the general ledger. The document review method involves reviewing existing transactions or documents to make sure that the amount recorded is the amount that was actually spent.

In double-entry accounting, each transaction is posted as both a debit and a credit. Secondly, account reconciliation helps identify fraudulent activity committed by employees, dishonest customers, vendors, suppliers, or cyber-thieves. Duplicate checks, unauthorized credit card activity, or altered invoices are some common practices that can be identified through account reconciliation. Reconciliation for accounts receivable involves matching customer invoices and credits with aged accounts receivable journal entries. It makes sure that your journalizing adjusting entries for depletion customer account write-offs are correctly recorded against the Allowance for Doubtful Accounts and that discrepancies are addressed.